2021 marks three years since the launch of California’s legal cannabis market in January 2018; this milestone is triggering a wave of audits by the California Department of Tax and Fee Administration (CDTFA), as originally reported in an article published in Marijuana Business Daily by John Schroyer titled “California marijuana firms face more state tax audits, millions of dollars in unpaid taxes.”

The article states that “cannabis tax experts warn the industry should expect state regulators to ramp up tax enforcement, noting that several audits of marijuana businesses are already underway.”

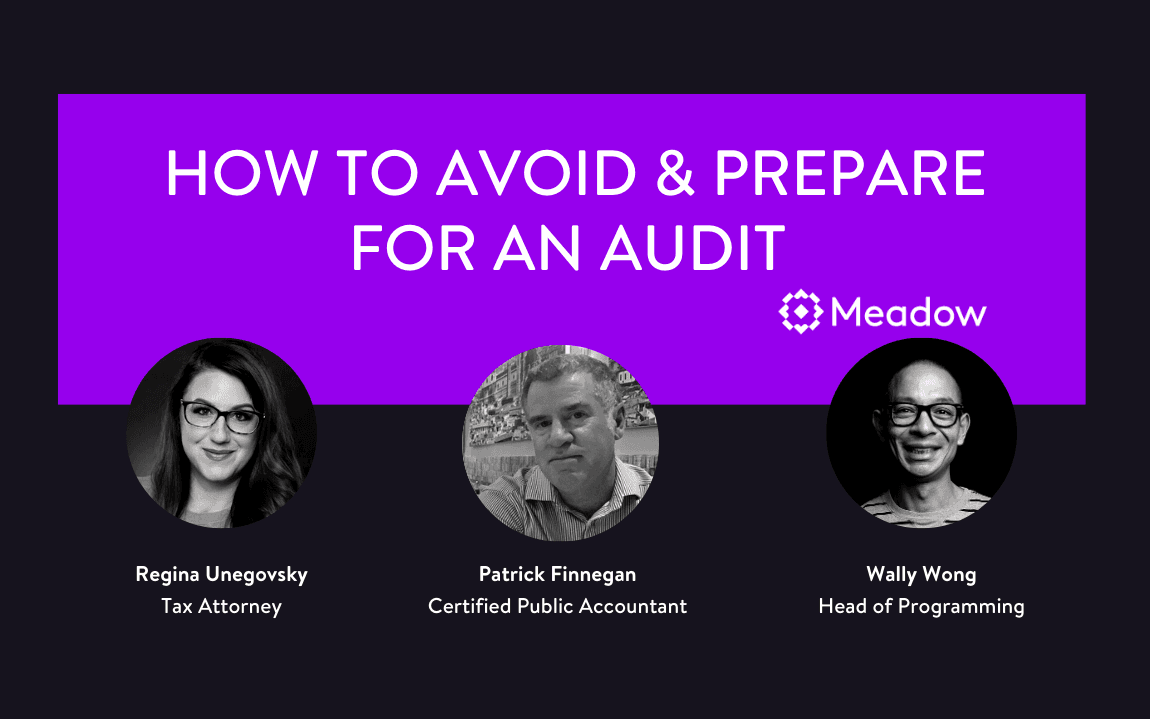

We asked two of the tax experts quoted in the article, CPA Patrick Finnegan and Tax Attorney Regina Unegovsky, to shed more light on what’s going on with taxes, tax enforcement, and what to do in case of an audit.

The three year make California’s legal cannabis market, which equals the state’s statute of limitations for how far back auditors from the California Department of Tax and Fee Administration (CDTFA) can go to examine business tax returns.

In this discussion, we learned that the CDTFA is increasingly reviewing Metrc accounts and using inventory variance as a means of audit up and down the California supply chain, which means having a system that keeps you fully compliant is more important than ever. While other systems let you oversell, Meadow's built-in guardrails keep you compliant with clean inventory in all of your sales channels (in-store, delivery & online).

Learn more about Meadow's cannabis compliance software.