June 22, 2022 - San Francisco, CA

As some cannabis retail and delivery operators look to be acquired or expand their footprint, this M&A panel was designed to help dispensary operators better understand how to evaluate strategic relationships, vet deal terms, create fair contracts, sell licenses and consider how to prepare a business for a merger or acquisition.

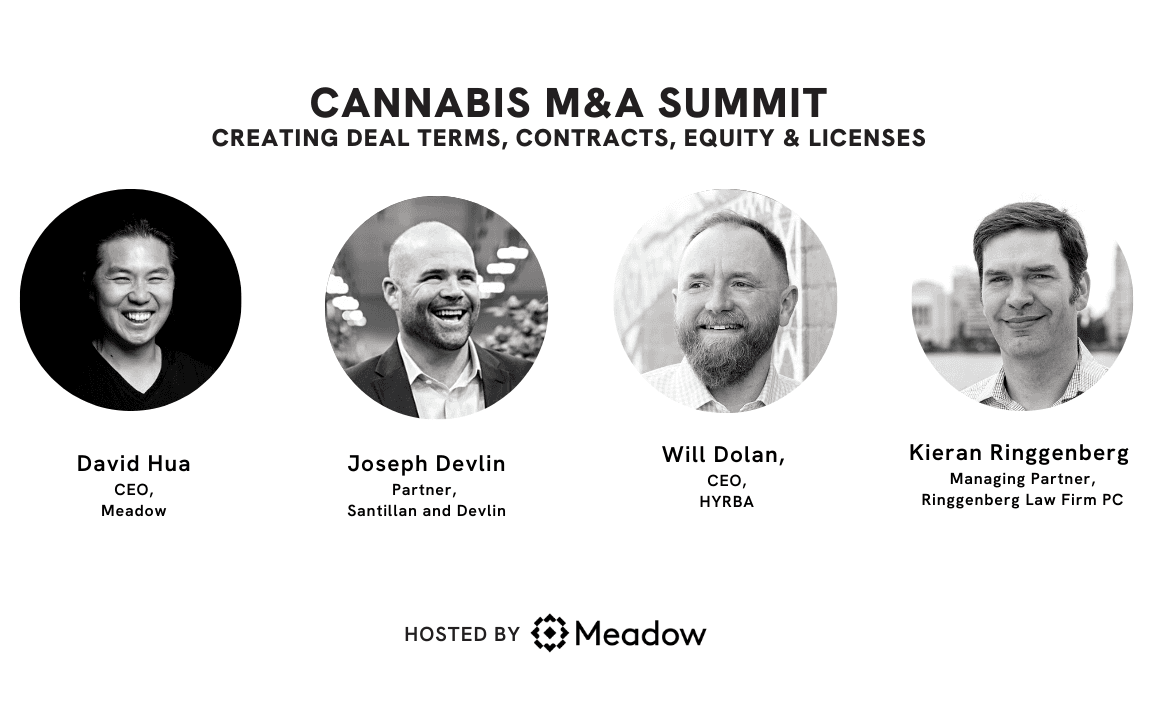

Moderated by David Hua, CEO, Meadow with:

Read the transcript, edited for clarity, below:

Hua

Today we're going to hopefully give you a good lay of the land. Where are we right now? What are you seeing in M&A conversations? It's unique that everyone's battling in their own silo and it may be helpful to get a little bit more perspective on the landscape and what we're all facing or a part of.

Kieran

Where we're at right now is “fighting for survival.” Most of the operators that I worked with, the tap of incoming capital has maybe not been turned off, but it's definitely turned way, way down. And so the focus now is getting cash flow positive, or at least neutral, figuring out a long term path for a business that can make it to the end of the year and past that.

On the M&A side, a lot of what I'm seeing is what I would defer refer to as salvage jobs, meaning there's a struggling business that might have potential, but is in over their heads, new owners coming in, trying to save the day. Maybe that's an adjacent business. Maybe it's a new investor. And so it's a lot of cleanup. It's a lot of trying to figure out what the problem was and see if there's a viable business there going forward. The other thing I've seen a lot of lately is people looking for dance partners. So maybe it's a production company that wants retail or maybe it's retail that thinks they can do better if they had integrated production. And so maybe there's not a lot of cash involved, but they think there's synergies in putting the pieces together or expanding geographically, like, Hey, one store, doesn't do it. If we had five, maybe it's making more sense. And so that's where we're at.

Will

From my perspective the market is starting to normalize, right? I'm using that in perspective to my experience prior to cannabis, which was in working in the hospitality field, advising on hospitality transactions, working with bar restaurant and hotel owners, and being familiar with valuations in that industry, having to raise capital in that industry and just transactions generally. And so a lot of people may be surprised about what's been happening in the market with cannabis. But to me, it was expected where in 2017 to 2019, I consider those the two years where decisions were being made in a very speculative fashion. They weren't based on numbers. They weren't based on the retail world, they weren't based on locations of stores.

Valuations were based on speculation and based on the land rush or green rush and just trying to lock down licenses and trying to get a foothold in the industry, not based on the fact that these stores were profitable or that they had long term potential. It was what I call investing with funny money that didn't really make much sense at the time. I've always known that was not sustainable. Now we're starting to see that, and that's not necessarily a bad thing. It's just reality setting in that numbers matter. Looking at financial statements, profitability matters, scalability matters. If it's a retail store, for example, does the brand have potential to be scaled?

Do the locations actually make sense? Is this a location that gets a lot of foot traffic? Is it an active location? Or are these stores in an industrial zone? Or somewhere where there's not gonna be a lot of foot traffic. These are the things that people weren't looking at as closely as they are now, and now all these details matter. It's not necessarily a bad thing. It's just cannabis as a business, especially in a retail world. Most of my experiences dealing with retail businesses, these metrics matter.

Joe

I've seen some what I would describe as anxiety amongst a lot of business owners as they're trying to understand what their value is and maybe questioning their business model and their long term sustainability. While you have some other groups that are maybe still looking to invest and acquire but they are really drilling down into those business fundamentals. That's where I've begun to see the separation or misalignment.

Hua

Let's talk about who's here. Especially because we have such a mix of players between legacy transitioning into traditional new operators, getting licensed today, basically doors opening now to people that have been operating for a while and maybe trying to make the numbers work.

Kieran

You laid out in broad terms, which is there are folks who've been in the business for a while who maybe had a viable economic business and it's transitioning into the regulated system. And as that evolves with some increased competition, a lot more rules, taxes, compliance issues. You have the complete other end of the spectrum are the national MSOs, which are small in number, and at this point not terribly interested in California because it's a really competitive market and there's no money to be made here in their perspective for the most part. And in the middle you have people that have either started in, or after 2018, and/or folks who have substantially changed the business they're in. And there's quite a bit of that because in the early stages, a lot of people were just grabbing what opportunities they could. And then now kind of the game of musical chairs is over and people who had four or five businesses ongoing, they're going to pick the one that has the best legs and stop with that.

Will

It's definitely a different landscape than it was in the two or so years prior to COVID when things were all just getting started, preparing for permitting that started in 2018 and licensing here in California. And at that point you saw all the MSOs, all the largest companies, everybody was kind of here salivating for any place in California, San Francisco, Oakland, Los Angeles. And they were signing deals that didn't make any sense, signing leases that didn't make any sense, even purchasing buildings at that point in time, you know? And all that has come to an end here in California. There are some MSOs still doing projects that have been in the pipeline, but I'm not really seeing any new ones coming out here with any interests. And I'm also seeing MSOs default on leases, hand keys over, and walk away from projects.

They signed up in 2018 and 2019, because they're realizing that it doesn't make any economic sense. If it's something that's going to be operating in the red, most likely based on a lot of factors. So what I'm seeing now, besides upstart independent businesses, is what I call more like regional operators, and some of the fastest growing companies in California are these operators that maybe have between 3 to 10 units in existence and they're just scaling. And they're very bullish on the state of California because that's where they were founded. And they're down in Los Angeles and up here in Northern California that are really very active. That's the difference, where we didn't have these companies back in 2018.

There wasn't really any of these west coast regional type operators. The MSOs were the main players, but right now it shifted a little bit. There are some companies doing well and really starting scale in a way that's looking good on paper and they're in good locations. We're going to see more of that in the next couple years. And those companies probably are going to be targets of MSOs when everything is all said and done. And they have a strong balance sheet and a P and L that is in the green and everything looks good. Then, I think we're going to start seeing MSOs come back in one to two years from now.

Joe

I have one client who is more institutional money and has zero interest in California. And then my clients that are actively looking for acquisition targets in California are regional operators that do have an infrastructure that have 6, 7, 8 stores and maybe they're vertically integrated. That is where I also am seeing most of the activity and demand around.

Hua

In the last decade, there's been a number of funding vehicles and instruments for this industry. We've had multiple boom and bust cycles. Let's talk about the current view on where the money is at the moment.

Kieran

What I'm seeing recently is almost all significant financing is debt based and almost exclusively based around real estate. That's the one thing that people are still willing to lend on. There's a little bit of funding to real estate adjacent projects. Maybe it's an operator with the option to acquire their property and that's enough of a hook to get real estate investors interested. If you look at any of the large transactions that have been publicly reported in the last six months, every single one of them is a loan based one. The other thing I do see is just private money in small to medium size transactions to acquire businesses or do rollups. And that's typically going to be either private office money, meaning rich family money, unencumbered, or something that's made up of that type of money and some kind of funder roll up. I'm hesitant to say it, but I'll say it anyway: the one other source of money in the industry is people who are making a lot of money exporting product outside the written system and trying to get in the legal market or using it to expand their business that plays on both sides. I don't know what percentage of the funding coming in right now is that, but it aint zero, I know that.

Joe

There's the folks that I'm seeing still investing, who came into this industry with some amount of capital or they've been that regional operator that has grown and really found some success and still has positive cash flows and is maybe still then also attracting some investment capital. Because of all of the licensing complexities and the tax complexities with the state, we still have the big institutional money really sitting on the sidelines. I don't think that's going to change for the next couple of years. It really is going to be this patchwork hodgepodge collection of smaller family office money, successful operators organically growing and expanding. It's going to take a few more years before any institutional money comes back into the state.

Will

The financing markets are extremely difficult. There's not a lot of capital and there's a lot of capital on the sidelines. But there's a lot of "wait and see" happening. It's a challenge even just to raise money to on a small project from an individual. But there are small family offices, high net worth individuals, it's just a more grassroots type approach to financing right now. Even in the real estate world there were several multi-state banks that were lending on cannabis, real estate projects here in San Francisco and in Oakland and in Los Angeles that have now backed out. These were banks that were actively in the space that have now decided they're no longer in the space.

Joe

The real estate piece is so important to any deal. Generally it's the first or second question I'll get about a potential acquisition target is, do they own the building? Does the property come with it? Is it an option? And if the answer is no, it probably doesn't happen.

Hua

The relationship with the landlord is such a dance. Maybe walk through some of those relationships that you've seen and what the path forward is in that case.

Joe

A big part of it comes down if you don't own the property, what are the terms of your lease? And, how tight is your lease contract? It gets back down to the business fundamentals. You can't overpay in rent because you're overpaying in taxes and you're overpaying for everything. Something's gotta give and real estate and rent is so foundational to a sustainable business model that if you don't own the property, you've gotta have a really tight lease that they're gonna feel comfortable coming in.

Will

The commercial leasing is something that has been one of my professional focuses for about 12 years. I've done about a dozen cannabis leases here in San Francisco, from leases with individual equity applicant operators, all the way up to leases with publicly created MSOs and everything in between. In San Francisco there were leases getting signed up in 2017 to 2019 that were probably two and a half, 3x, what the market lease rate should be, and those leases are falling by the wayside if they haven't died yet, they're probably in the process of dying now. It's incredibly important to have a lease that, that doesn't necessarily need to be market rent. There's a lot that goes into entitle in cannabis and finding a property that works for cannabis. Maybe a cannabis lease is a higher lease rate than a restaurant. A worst case scenario is like this lease in Union Square; we had discussed this a little bit earlier, that was signed up by Have a Heart back in 2018. It was transferred to Harvest to Arizona, in about 2020 or 2021. And then it was packaged up in some crazy M&A deal with High Times. And if you've been paying attention to the media around this project, the owner of the building, which is store equities, which is a landlord that's very established in New York real estate, the landlord is not someone that's going to cut a deal for you and someone that, that demanded a very high price for the Union Square asset. The rent was well over $200,000 a month. And now the operator defaulted and the landlord has a suit against them for $5 million in back owed rent. Obviously that project's dead; it was dead the moment they signed that lease.

It was a circus card basically. And I don't even know what happened in that transaction. And the company Have a Heart had five leases in San Francisco that all died, you know? So they struck out on all five of 'em because they were signing leases that were two to three times market lease rate. And then none of these projects saw the light today, every single one of 'em died. Somehow this stuff was packaged into an M&A with Harvest. These are the pitfalls you need to avoid. And the landlords got screwed on all those as well. Everybody lost. Folks were signing deals up and down the state, without any intention of performing solely to try to flip these projects. To try to create some artificial value. And then, I'm gonna sell my five stores for a hundred million and walk away. And there was nothing behind it. It was an unsuccessful strategy.

Kieran

I would just add that a key factor is what's the next best use for the property? Owning a building where a cannabis tenant leases is a hassle because your financing is significantly more expensive on the building than it would be with any other business. So no one would do it if they're not getting a premium return. It doesn't make sense. You have to consider that in San Francisco, every real estate is valuable. There's no such thing as useless real estate in the city, but in other places there are. So if you can find a building that doesn't have a great alternative use, then the ability to acquire or lease that site is significantly improved and even crazy 2018 leases can be revisited if you convinced the landlord that there's no future at this rent rate, but you can still get a premium return if you agree to something that's a little more reasonable. I've spent a ton of time in the last year having that discussion with landlords: if you want this guy to stay, you have to lower your rent or he's out of business and then you're going to get 30% or 50% of the rent from someone who's non cannabis, what do you want to do? And some landlords are willing to negotiate and some are aren't if the building's been sold on the assumption of the high rent rate, you're probably SOL, but if it's a reasonable landlord who has common business sense, then there may be something to do to make that work out.

Hua

What does that look like as it plays out, or if you didn't necessarily set it up for success and you're on the back end of it operating, what is a way to inject some vitality back into it to, to move it along? Now we're dealing with a mixture of different operators at different stages, with different cap tables, varied financing, but still trying to figure out their path forward.

Will

When he's talking about front end, back end, I work with a lot of folks on the front end of the process, and this is going back about six years since I started focusing on cannabis. This is from someone coming up with an idea and having a business plan and saying, Hey, I need to find a property for my business. And then I need to find some partners and we need to put together an operating agreement for LLC and what their vision is. If it's a one off store, M&A considerations aren't necessarily a big deal, but a lot of folks have a vision to scale their business and expand. Maybe vertically and they want to be able to set the stage for what's the five year exit strategy.

And whether it's an M&A, or whether it's a public listing, a lot of people have been thinking about this. What I've done is just work with them to try to create a platform, to prepare for M&A in the future. To prepare a business structure that's clean that will be saleable at some point. Obviously there's a lot of regulatory hurdles involved in this conversation, especially in jurisdictions where there's an equity program, like Oakland or Los Angeles, there's all these regulatory requirements in order to complete an M&A, and so some of the stuff that we're doing now, maybe an M&A wouldn't even be possible based on the regulation, but you can set yourself up for success in the future. That's even from thinking you're operating an individual LLC, and you're planning a scale thinking about how to keep that LLC with the minimum number of members, right. And maybe holding the interest in a parent corporation so that the LLCs on the front end that are operating the businesses are owned by say a C Corp, for example. And then the C Corp is where you focus your M&A potential. You try to focus on the C Corp owning the cultivation, owning the retail and each of these operations are individually held and keeping the number of members to a minimum on the front end. And having the investment on the parent side.

This is the type of structure that I've been recommending and helping people put together over the years, and probably the best way to set yourself up for success in the future. The regulatory stuff is so important that the way I've been approaching the process is before even signing deals, I run stuff through our local Office of Cannabis here to get feedback. Initially we weren't doing that. Sometimes we had to amend the deal documentation 4, 5, 6 times, costing people lawyers' fees and everything else doing it that way. We learned our lesson: get a thumbs up before you start doing deals, and disclose everything. I'm now dealing with situations where folks didn't disclose certain things to the Office of Cannabis. And now two years go by, and they're trying to do something else and you're having to disclose old documentation and that's creating a whole new headache for folks. So disclosure and regulatory compliance on the front end is extremely important and it can blow deals in the future and on the back end in an M&A; what you screw up on in the beginning can blow a deal down the line.

Joe

The folks that I'm working with that are acquiring businesses or looking to acquire, they generally have a business plan and a model, and they know what they're looking for on the folks that are maybe looking to exit that process has been very much different. One of the things that I've tried to do with business owners is get them to think about value, and not just the dollars. If you're going into make an exit, you really need to think through what do you value? What are you looking for in this exit? If it's just dollars, that's not going to be a great fit. Ultimately in an acquisition and merger, it really comes down to about fit and integration and also why you're doing this because that drives so much of the value. There's so much more about selling your business, that you've dedicated years of your life to than just dollars.

I really encourage folks to identify what is valuable to them. You're going to have a hundred decision points that are going to affect value along the way. And you need to really distill what are those pieces that you value. How is it going to be operated? Is it going to be maintaining the name? The employees? Is there some elements of your legacy of the company that you want to see carry through or are you just selling the license and taking the exit? There really isn't just a template that you can just overlay and say, well, this is how this deal is going to happen.

Kieran

You really have to put yourself in the mind of your potential acquirer or a merger partner and ask what they're going to value in this transaction and focus on that. There was a time when it was a viable business plan for a cannabis business to get a license and figure out later how to raise the money and get an operation. And that's over. So now we're at the time where, whether you're at the beginning or in the middle, you need to make sure you have a plan to survive without additional fundraising, unless you have a very secure source of funding that you can rely on because the days when you could say I got three months and by then I can raise some more money, and it will take me over until someone buys me, that's just gone.

There are some businesses where the value is really just the license. There's not really anything else there. And if that's the case, you should really be managing your business with the strict eye to the bottom line, because the debt that you're accumulating is just going to cut against the value you're going to get for the license.

In most jurisdictions, you have to take the legal entity that holds a license. And that means you have to take all the debt comes with it. And if you've run up a big bill, that's got to get paid before the owner gets a dollar. It might seem great to make these investments, but if there's not a business plan to get a return on that investment, you're better off running it at absolute minimum until someone buys the license. That's not a great business. There are predatory lenders in the industry right now who are cutting these deals where they're charging 30 or 40% interest on short term loans to desperate cannabis operators. It's a death spiral that ends really quick. I just want to having tried to solve that problem for people who have already made the bad decision to take that money. I want to advocate to avoid it at all costs, because there's not an easy exit from that situation.

Joe

One of the first things that kills a deal is tax liability. Somebody wants to exit, somebody wants to buy, great. We have a general agreement on price, and start doing the due diligence. And then that number for the offer goes down really quick. I've watched it kill a number of deals and it's painful, because you spend months and months working on these things and then inevitably falls apart because the tax liability is, 50%, 75% of gross revenue. Back to your business fundamentals, you know, the business is really in a death spiral and the investor or the person looking acquire says, well, I may as well just wait. I don't need to buy this now. I can call you up in a year from now. And you know, you won't even be around or, I've watched people just hand over the keys, acquire the company. People basically acquiring it for the debt. You know, just let me walk away from this. I know that there's at least one in the Bay Area that just went through that exact deal. Managing the bottom line is so important. And being aware of, are you digging yourself into a tax hole because that will just cut right across your valuation.

Hua

What does a light at the end of the tunnel look like? What are some of these scenarios that are catalyst events that improves the value of that asset to a point where you are willing to exit at? There's still a huge gap that we're seeing in consumer education. Let's talk about that.

Kieran

I can see three. One is the floods carry off a lot of the chaff and the survivors that are left have a real business that could make money. It's going to happen. Two, we get federal legalization or something like safe banking that opens up the door to real finance to get the institutional money off the sidelines and into the business. And then you're going to see some rapid rollups and these big companies are going to steam roll. But if you're in the roll up, that could work out really well for you. And the third is someone has a real unicorn of a unique business. Maybe it's their location. Maybe it's a brand that has something truly extraordinary where you could make a killing in the current environment. And with the exception of retail, in a truly extraordinary location, the number of folks who are going to pull that off is probably real low. I don’t want to be a bummer. So let's focus on the first two.

Will

For the next two years, any market, especially in this infancy like cannabis, we're going to go through growing pains. All operators, whether it's retail or some other within the supply chain, really need to focus on their fundamentals: focus on getting costs under control, on trying to create or maintain something really unique because competition is here now. I relate it to the restaurant market; it's the most competitive business market in existence. These restaurants have the highest rate of failure of any business out there, because it's extremely competitive. But some restaurants are killing it. Some are just surviving and a lot fail. It's similar. You really have to focus on differentiating and trying to stand out amongst your peers because it's becoming a crowded field, especially here in San Francisco. By the day, we're hearing about new stores opening, we're still getting applications coming into the pipeline here.

For all cannabis uses, especially with retail, location matters, marketing matters. What can you do to offer consumers and experience beyond just products? Because everybody has the products. You can get the products delivered in 15 minutes from 25 different delivery services at any given moment. Why am I gonna go out of my way to go visit a store, maybe that's not in my own neighborhood or why am I gonna do something that's not just for pure convenience? There has to be something else there, there has to be an experience there. Consumption's a big part of the retail market moving forward, and just the next two years is really about trying to stand out and trying to weather the storm and preparing for a very competitive market. The folks who weather this storm are going to come out on the other side and be in a great position, especially from an M&A perspective. There's a lot of folks waiting on the sidelines to see who gets through these challenging times. That's what the focus should be for the remainder of this year and for next year.

Joe

I'm still very optimistic about California as a brand. The minute that we get interstate commerce, I imagine it's just going to be like a fire hose spraying weed across this country. That's what we've been doing on the illicit market for the last 50 years. There's a cache on the retail side. I believe we will get 280-E reform. If you can survive the next couple years and you still have $3 million to $5 million in 280-E debt racked up, I don't think the federal government's going to wave that. You're going to have to be able to survive up until that point.

Hua

280-E would boost the bottom line. That's a terrible burden. The other question is, how much will the government take if there is interstate commerce or legalization in that frame? There's still some outlying questions there. SThe strongest steel is forged in the hottest furnace. If I'm a current operator I'm thinking about who my dance partner is going to be, walk me through the milestones or the things that we need to go through.

Joe

If folks are looking to make an exit, you want to establish what's called a BATNA, your "best alternative to a negotiated agreement". If this falls apart then, what's your fallback plan? Sometimes that's very easy to identify. Sometimes you just know it inherently. But if you don't have something that's clear, setting what can be called like a trip wire: what's your yes or no point of like, okay, if I can't get this right, I'm out. Establishing those two things are one of the first steps.

Kieran

California is the most competitive market in the country for cannabis, no question hands down. When we do have interstate commerce, our operators have already been through the ringer and we're going to eat the lunch of those MSOs, who only have two competitors in a whole state, because they have no idea. And what they're doing right now is trying to set up regulatory barriers so they don't have to compete with us. If there's a light at the end of the tunnel, that's it.

The most important thing is, does this business make sense? Do I have something that someone would want to buy? Get your house in order from an administrative point of view. You need to make sure your tax returns are filed and professionally prepared. You need to make sure that your corporate documents are done and correctly organized. Any real investor or potential acquire is going to want to see is the same set of materials. And we have a very good due diligence list. For most people, it's going to be really scary, because it's got a lot on there that most people don't really have. But regardless, get all your information organized in some way. And the first time someone is really taking a hard look at your company, they're going to say "give me your data room" and you'll have all your stuff in a Google drive or a Dropbox.

Will

One thing that's important is thinking about the front end and starting businesses to prepare for an M&A in the future is to look at this in a jurisdiction like San Francisco. You have to look through an equity lens, right? And look through our equity program and think about a lot of these businesses here in SF, especially retailers, have an equity partner, right? So whether the operator owns one store or three or four stores, it doesn't really matter that they'll have a percentage of each of those stores owned by an equity applicant partner.

There's a lot of opportunity for equity applicants in these types of future M&As. San Francisco requires 40% ownership of the operating entity is the equity applicant, having the ability to fold their interest into the parent so that then they can then take their 40% shares and turn it into shares in some larger parent corp, have some real skin in the game at that point, and then participate in the M&A. There isn't some type of segmented transaction happening where there's an M&A happening, and only 60% of the operating entity is selling in that M&A; a hundred the operating entity can be turned into a single member entity held by the parent. The equity applicants interest can be folded into a parent corporation.

They can stay involved, they can stay invested and create some long-term value. That's really important on the front end is to set expectations. And some folks want skin in the game. They want to have long-term involvement and they're not looking to just enter the business transactionally. From the onset, it's very important that the operating partner MSO or the local operator and their equity partner have expectations that are set.

It's important for equity applicants too, to look at their partner, because a lot of times maybe there isn't value there and maybe they don't trust their partner. And that's why they don't want to participate in the M&A that in other situations, the partner is doing the right thing and doing a great job and everyone's going to benefit from working collaboratively. I've been trying to ensure when people enter into these deals together that they all play nice with each other so that an M&A can happen in the future.

Joe

Once you've started the process or you've made a commitment, you maybe found your dance partner, if you will, you need to do the due diligence on yourself first.

I've seen a lot of offers that includes stock. What is that value based on? Back tothese fundamentals. You have to do enough due diligence to actually value their stock. Any deal that is stock, I've seen a lot of seller carries where someone'll give you 30, 40, 50, 60% now and the rest remainder of funds over a period of time. You need to be very good about your due diligence about who this person is, how capitalized are they? What does their business model really look like? If you're not getting all of your money up front, it's really a hope, right? So what you're really getting is what you got in that moment and a hope that you're going to get paid somewhere down the line. And or if it's stock, a hope that it's still going to be worth something; you might sell your business for $7 million, five of it is in stock. But when that stock drops by 90%, you essentially get very little.

Hua

What's the best practices in vetting the buyer or vetting the partner? By the way, we do have a due diligence document that is pretty comprehensive from Clark Howell. Let's talk about the buyer and let's talk about price. What's the realistic viewpoint of the market? What are the numbers people are looking for? Is it some of the value pieces you're talking about?

Kieran

The pricing and the current market is too idiosyncratic to give you any answer that is going to be meaningful. And that sounds like a cop out, but it's just the truth. I do think it's clear that the days where the valuations are based on topline revenue are over. But what is the new answer? Probably something where you look at someone's cash flow or EBITDA on a projection basis. What's this business going to be doing over the next three years? And how much money am I willing to pay to acquire that profit stream? That's the basic analysis, but it bears only a tangential relationship to last year's financials because the industry is changing so fast.Tou have no idea what you're going to do next year, because we have 2020 COVID and then we have a period of crazy inflation that we're in right now. If I was a financial analyst and I was looking at a five store retail chain and trying to assess what I thought they were going to do in 2023, it's really guesswork. There's really no way to know because everything's changing so quickly. What are the alternatives to the acquisition and what are those looking like? What could the deal look like? It's pretty simple. You can get cash. And if you have a cash buyer, your diligence can consist of "show me the money." Because after that, you don't really care. You could have debt and if someone's acquiring your business substantially in debt you really need to take a hard look at what expectation they're going to be making or acquiring enough money to make the payments over time.

A lot of times it's a shell game where they don't have the money, but they're expecting to sell their business and use those proceeds to pay you, which you can probably guess what my view on that arrangement is, right? It's not positive. The third thing is some kind of equity consideration. In this market, there's a lot of business combinations where it's not really an acquisition, it's really pieces of a puzzle together. And then it's trying to assess what's the relative valuation of the two businesses. So you can know what the owners are going to get, what percentage at the end of the day. You have to go in that same analysis of what are the other things on the market? And what would they cost or what have similar things sold for recently that puts a tag on it? You put 'em together. So if one business is worth 10 million and one's worth 15, presumably the guy who adds the $10 million business is, is gonna get 10 over 25% and vice versa, right? And there's a black science to that valuation. But at this stage in history looking at other business combinations and sales that are as close in time as possible is the best means valuation that's available.

Will

A couple things on valuation points I'd like to make, similar to other types of businesses, even similar to real estate. One thing that I do and always recommend people do is to start looking at comparables. I call 'em sale comparables or they're comparable transactions. Whether it's a single store or whether it's a package deal like an M&A that includes multiple stores or maybe some vertically integrated businesses, all inclusive. That's something that I use as a way to set parameters and guardrails. I also like to use the terms floor and ceilings. You can look at what's the pricing floor, what's the pricing ceiling and you start there. You also, as a caveat, can really only look at post-COVID transactions. In this sense, you have to write off what happened prior to 2020, because it's just not the market we're in. It's not relevant. I generally start looking at comparables and there's not a lot of data out there with cannabis. It's not like real estate or some other business where there's a database and you can go look the last 12 months with a hundred comparable transactions. You can pretty much say our project is probably worth within a 10% range of where these other transactions are trading. And you can come up with a number almost like an exact science, like what an appraiser does when it comes to real estate, but you can't really do that in cannabis. So it's very limited data out there, but if you use that as the foundation, and then you start getting into the numbers.

The easiest way to start is to look at revenue multipliers. You can look at what projects we're trading at back in the early days prior to COVID and then what they've been trading at in the last couple years. What I've seen out there, not just firsthand, but also tracking the media and the news around this, is that listening to folks, not just in California, but reading about stuff that's happening in other states as well, you were looking at prior to COVID, two to two and a half X revenue was very common. You'd hear transactions happening all the time, not even non-existing revenue, but two to two and a half X on projected revenues. And sometimes even three, three X. And so now this is from also talking with VCs and talking with folks that are actively investing still actively investing in a much more conservative way. They're looking at revenue multipliers, probably into one range to one and a half. If they're just operating stores without really much scalable value, no strong brand behind them, it's gonna be probably on the lower end. So probably about a one revenue multiplier. But if there's some other value, some ancillary value, like a strong brand, there's something that can be scaled out beyond just that individual store, then you're probably going to be looking at a one and a half X, or somewhere in that zone. And this is very general. This is just kind of thinking about what the market is telling me, because I always tell people the price or the value is not what you think it is. It's what the market tells you. It is. Right? So the market determines the value. That's where we are. There's no way to predictvalue in a sense, but you can look at these parameters to set your expectations. And then if you're a seller, you obviously you take the highest position you can take, but you have to be reasonable because if you came to market today and say, Hey, I have three stores and they're doing 20 million a year revenue, and I want 50 million for my business, someone's going to hang up on you. They're not even going to take you seriously. But back in 2018, 2019, a three store portfolio would probably easily sell for 50 million. And now not even close.

Joe

Value is difficult. To the question about the buyer,to the extent that you can get to know them, I would encourage that. In some ways mergers and acquisitions are kind of like getting married with the intention of getting divorced, but when you finish the divorce, you have to be able to call up your former spouse, and they're happy to hear from you. This should go well. It is a very intimate process. So get to know them. Some of the proposals that I have been around recently are a one X minus 280-E liability, or just tax debt which often doesn't leave a lot of meat on the bone. If anything above that, the buyer is buying it for one and a half or two, start pushing that. And those deals just don't exist right now. We're going to start hearing more about EBIDA and that's going to be the baseline metric of how things are going to be valued, unfortunately, until we get 280-E reform. That's going to be a tough metric. I don't think anybody's figured out what that formula looks like. It's going to shift towards that more traditional EBIDA some multiplier of that and maybe between now and 280-E reform, it's going to be an EBIDA with something. And I think that something is going to be bespoke to every agreement whether it's a strategic acquisition or how it fits into that particular deal and creates value. It's understanding your company and all the pieces that bring in value. Do you have intellectual property? Do you have certain geography? Do you have certain brands? All of that will help understand what value you're bringing to the table that also will help you define the value for the person who's acquiring your company as well.

Kieran

If you hear that businesses are being sold at a revenue, multiple, the logical inference is you should run your business into the ground, lose a lot of money, but do a lot of sales. And I would suggest to you that's not a great business model. And that's the reason why revenue multiples are not the future of how these valuations are going to be done. It may be a factor, no question, but if you're basically operating at a massive loss in order to generate a lot of transactions, why would someone want to buy that business based on your revenue it's made up? That's a real thing that people have been doing in this industry, which is running businesses on massive losses to generate a top line, to try to get a sale price. And if you pulled it off, I guess, hurray for you, but I don't think anyone sitting here today could rely on that. The other thing I would add, I agree with Joe, that whatever valuation you get, the accrued tax debt has to be taken into account. And the same is also true of any other obligations you're asking the buyer to take on, whether that's accrued rent from your landlord, whether it's unpaid trade liabilities, whether it's CDTFA taxes that they haven't managed to steal from you; all that stuff matters. You have to focus first and foremost on your business fundamentals.

Will

Really good point. And that's why I keep saying that fundamentals matter, that the revenue multiplier looking at comparables, these are kind of just set parameters, set expectations, but when it comes down to it, if the businesses is say losing a hundred grand a month and you're a million net operating loss every single year, your revenue multipliers are relevant, right? There's not going to be buyers looking at your business seriously at that point. Bottom line is becoming more important by the day and, and that's what we're going to be looking a lot more in the next few years.

Hua

This has been great. Great wisdom. How do you see an operator unlocking value? We've been talking about value, value, value. How do we unlock it? What does it look like in terms of getting your fundamentals in order or your cap table in order?

Joe

There's a tremendous amount of potential in this industry. Look at your real estate piece, do you own it? What are your lease terms, getting down to business fundamentals. I don't think that we're going to see large influxes of capital institutional money in this state for a couple more years. It's going to be post federal legalization, which can be good because that that may give folks a chance to maneuver. There's tremendous opportunity in the next couple years around building alliances and a network of companies. Maybe you haven't found your exit right now, but, do you and four other people have the same vision? Are you all going to be ready at the same time? You can build your little team of folks that are maybe willing to present themselves as a package. And hold onto your hat because it's a never ending storm.

Will

Now more than ever, certain things are incredibly important and that's brand, marketing and really differentiating from the competition. From talking with VCs and smaller family office investors, the first thing that I hear from them is how is this different than the a hundred other projects that just came across my desk? How are you different from a hundred other competitors that are doing the same thing that you're doing? The answer should be, we're not doing the same thing and we're different in all of these aspects. And this is why our business is scalable and better situated than 99% of the field. How do you do that?

There's a local company here in San Francisco called Sunset Connect. And they put together gift bags for the Warriors, and somehow ot each of the players on the championship team the day before parade, a big gift bag of their products. And then Forbes published an article about this local brand here in San Francisco, and about the Warriors players, which is another whole interesting conversation: cannabis and professional sports. From a marketing perspective, this is invaluable. This is the type of stuff companies need to be doing to really stand out and to capture attention on a national level.

Kieran

Focus like a laser on your bottom line, because if capital is hard to come by, the only way you're gonna sell your business is you survive to the day when it can be sold. The bottom line has to be first and foremost at this stage in the cannabis industry in California. Focus on strategic relationships with other businesses that you compliment so that you can survive together that also present natural partners if you're working well together. It's going to get increasingly hard for the smaller players to survive solo. If you're a retail store, find another retail store that's not an immediate area that you can collaborate with, share marketing, share purchasing concepts. Maybe that sets the stage for a legal combination later. Or maybe it's with someone in production. The people I'm seeing doing better have good mutually supportive and healthy relationships with their important business partners. Our industry has been awash with unreliable, get rich quickers, and I'm glad to see them go. The people that survive are ethical upstanding business people who can be taken at their word. And if you are that person, it's going make it easier to survive because the other good players are going to want to work with you and the people that aren't, who've been taking advantage and exploiting others for short term game, won't be able to make it in the long run.

Hua

Well said. This was very enlightening. Thank you so much. We really appreciate your energy here. Give a round of applause, everybody.

Many thanks to our panelists for sharing their energy and expertise.

We're always looking for ways to share education and free resources to help dispensaries thrive. Learn more about Meadow's cannabis retail software.