Banking Compliance for Cannabis Retailers Made Easy

Meadow x Green Check Verified Integration

Finding compliant banking in the cannabis industry is tough. Dispensaries often face endless paperwork, outdated tools, and risk losing access to financial services. That’s why Meadow, the all-in-one cannabis POS, integrates with Green Check Verified (GCV)—the leading cannabis banking compliance platform. This partnership automates financial reporting, maintains strong bank relationships, and unlocks access to reliable banking, insurance, and payments—without the stress of manual compliance workflows.

About Green Check Verified

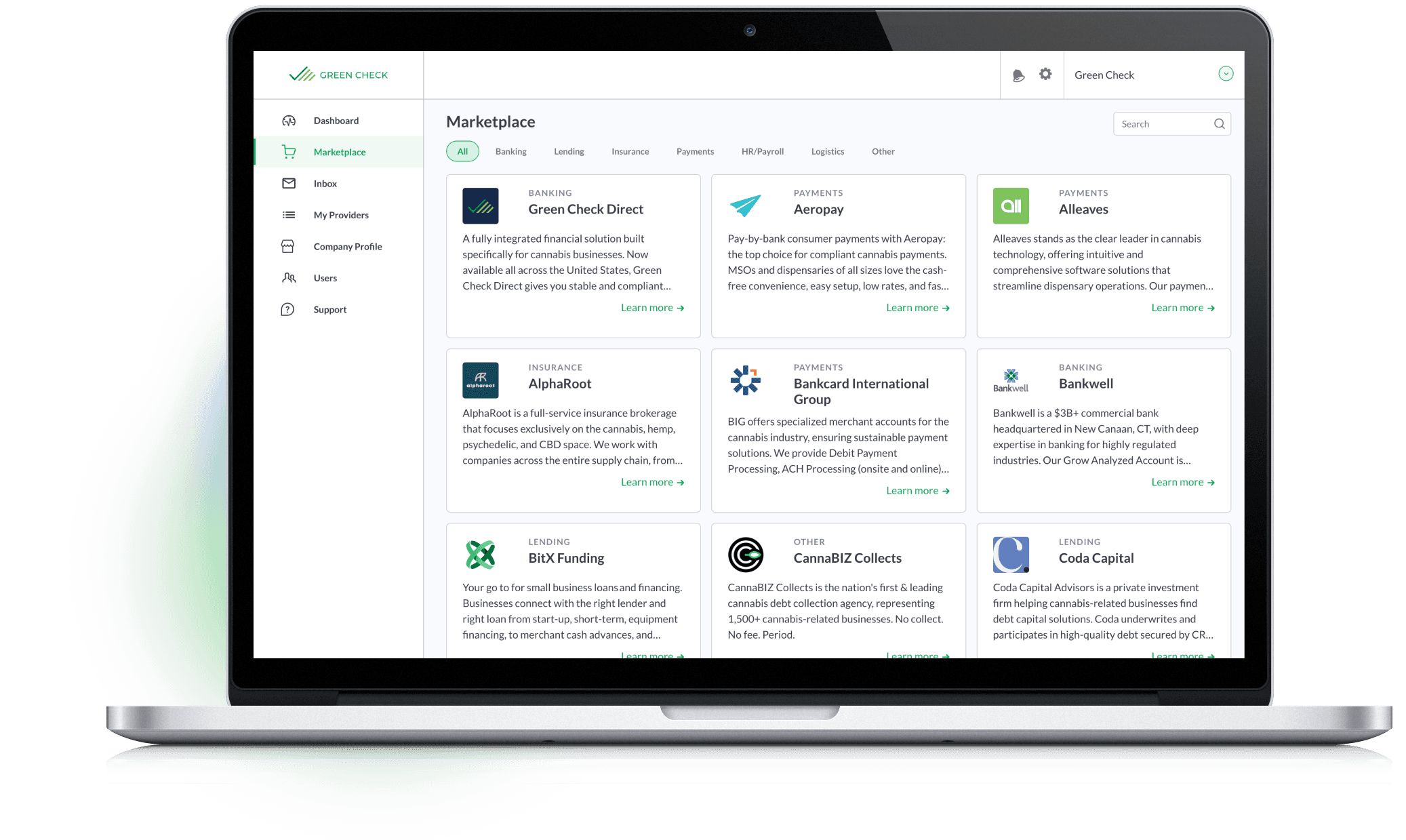

Green Check Verified connects licensed cannabis retailers with a network of cannabis-friendly financial institutions. Through automated compliance tools, transaction monitoring, and a financial services marketplace, GCV helps dispensaries reduce risk, simplify reporting, and access the tools they need to grow.

About Meadow

Meadow is dispensary software that unifies your sales, inventory, compliance, and eCommerce into one platform. Built to support integrations with tools like Green Check Verified, Meadow acts as the operational backbone of your dispensary to keep your data accurate and up to date, and enabling secure, compliant access to cannabis banking and financial services.

Key Benefits

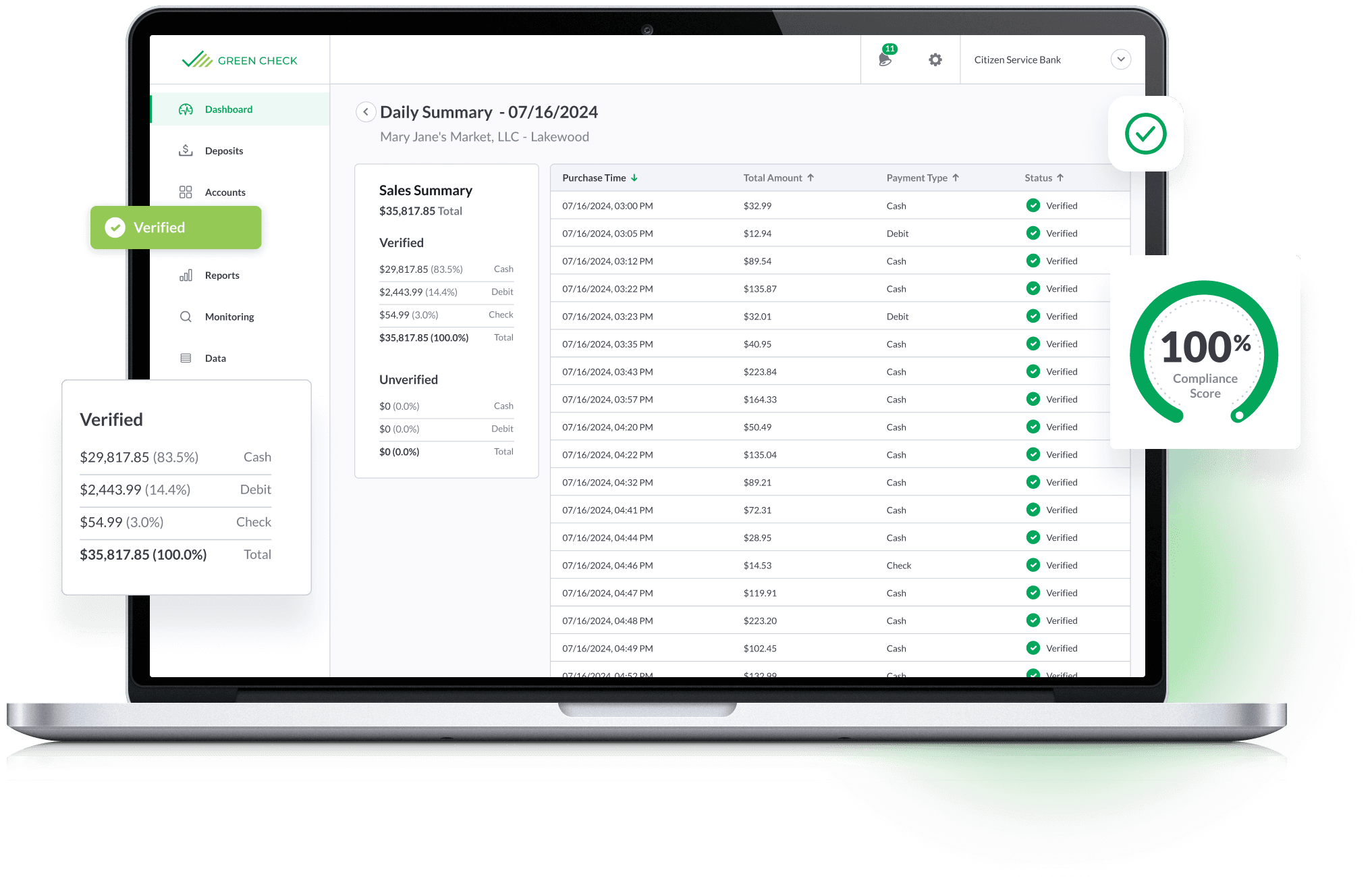

Automated Cannabis Banking Compliance Reporting

Automatically sync SKU-level Meadow sales data into Green Check Verified to generate the compliance reports your bank and regulators expect.

Access to Trusted Cannabis Financial Services

Get matched with compliant banking, insurance, payroll, and digital payment providers through the Green Check Connect Marketplace.

Accurate, Audit-Ready Cannabis Financial Records

Maintain detailed, real-time financial data that reduces the risk of fines, account closures, or lost partnerships.

Secure, Read-Only Data Sync

The integration is secure and non-invasive. Meadow provides read-only access to the data GCV needs nothing more. GCV’s bank-grade security means your data is protected at all times.

Stronger Relationships with Cannabis Banks

Give your financial partners the data transparency they need to strengthen trust and reduce operational risk.

Time Savings & Operational Efficiency

Automated transaction monitoring and reporting saves hours per week, allowing your team to concentrate on sales instead of spreadsheets.

Support for Industry-Wide Stability

Every verified business helps legitimize the cannabis industry, supporting broader financial access and regulatory trust.

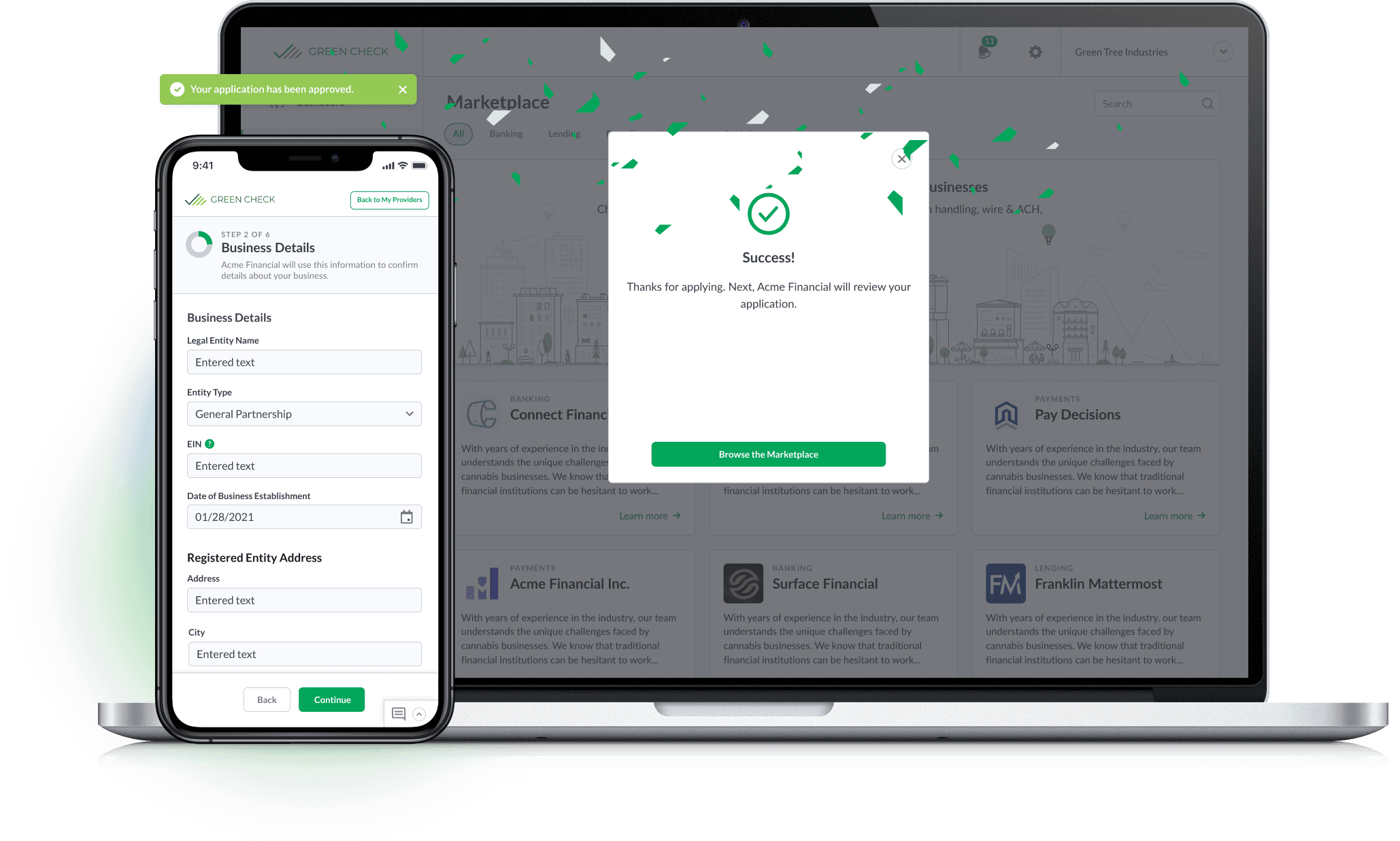

How to Set Up the Meadow x Green Check Verified Integration

Setup is fast, secure, and only takes minutes.

Generate a Meadow API Key

From your Meadow admin, go to Settings > API and create a secure integration key.Add API Key to Your GCV Account

Paste the key into GCV under Company Profile -> Integrations -> Meadow to establish the sync.Start Automating Compliance

GCV will begin pulling data from Meadow to generate reports and financial summaries in real time.

FAQs

How can dispensaries benefit from becoming Green Check Verified?

You’ll access a network of vetted financial institutions and reduce the time spent on manual compliance tasks.

What kind of data is shared between Meadow and Green Check Verified?

Meadow shares secure, read-only SKU-level sales data—quantities, taxes, discounts, totals—to support compliance reporting.

How long does it take to set up the integration?

Just a few minutes. Once your Meadow API key is added to Green Check Verified, data starts syncing immediately.

Why is banking compliance so important for cannabis retailers?

It protects your access to financial services, avoids costly penalties, and builds a reliable foundation for growth.